Click Here to Download PDF |

Accounting for Psychologists

The team at Sheridans have built a specialist reputation in providing accounting, tax and financial advice to a range of psychologists including clinical, counselling, educational, sports, forensic, organizational and neuro psychologists.

We understand the field of psychological science has never faced greater challenges. Rising social complexity, our growing and ageing population and associated chronic disease combined with technological advances in psychology training and practice means it is a challenging profession. Counselling people with life adjustment problems, emotional disorders or mental illness is both demanding and draining.

Over the years, we have mentored a number of psychologists and allied healthcare professionals from business start up to flourishing practices. right through to sale of their business. While practicing psychologists have the professional training and clinical skills to help people learn to cope more effectively with life issues and mental health problems, we have the experience and knowledge to help you build your business and grow your wealth.

You help people manage and overcome stress and anxiety associated with relationships, school, careers, family matters, learning problems or substance abuse. As accountants, we are in the business of helping entrepreneurs manage business and financial stress. Let us take care of the financial pressures, tax compliance deadlines, business administration, bookkeeping and superannuation obligations.

Partner Greg Sheridan says there are similarities between the accounting and psychology professions, "We both deal with the public and in many cases counsel people of all ages in delicate situations. The paralells don't stop there, as we both handle the needs of generations of families. And, most importantly, trust is a key ingredient for success."

THINKING OF STARTING A PSYCHOLOGY PRACTICE?

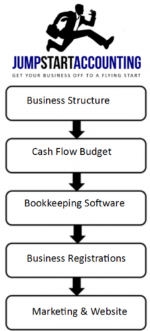

If you are looking to start a business as a psychologist or buy into an existing clinic, there are numerous issues to consider. You need to

establish your business structure, complete tax and GST registrations, consider insurances, select an accounting software program and

possibly explore your finance options. It can be a maze of issues but as accountants and business advisors we can assist you in all of these

areas plus provide advice on the preparation of a business plan, marketing plan and a cash flow budget. If you are contemplating employing

staff we can also assist you with human resource matters including payroll and superannuation guarantee obligations.

If you are looking to start a business as a psychologist or buy into an existing clinic, there are numerous issues to consider. You need to

establish your business structure, complete tax and GST registrations, consider insurances, select an accounting software program and

possibly explore your finance options. It can be a maze of issues but as accountants and business advisors we can assist you in all of these

areas plus provide advice on the preparation of a business plan, marketing plan and a cash flow budget. If you are contemplating employing

staff we can also assist you with human resource matters including payroll and superannuation guarantee obligations.

Over the past two decades our team of accountants have helped dozens of psychologists get their business off to a flying start. We offer you

experience, technical tax knowledge, marketing expertise and most importantly, an intimate understanding of the psychology profession.

Starting a business is a bit like building a house that requires solid foundations. In a business sense these foundations include the right tax structure and accounting software, adequate and appropriate insurances. Your choice of business structure is absolutely critical and there are a number of different options including sole trader, partnership, company and trust. When selecting the most appropriate structure for your business we always recommend you ‘start with the end in mind’ because Australian tax laws are complex and changing your business structure at some point in the future can trigger a capital gains tax event that could prove very costly.

Whenever we provide advice on business structures we always take into account:

-

Income Tax Minimisation

Income Tax Minimisation

- Maximize Asset Protection

- Allow for the Admission of New Business Partners or Investors

- Consider Future Entitlement to Discount Capital Gains Tax Concessions

As a consequence, we often find the business structure is a compromise based on the relative importance of each of these issues.

Another brick in your business foundations is your choice of accounting software. Poor record keeping is one of the biggest causes of business failure in this country and up to date, accurate financial records let you to make informed business decisions. The wrong choice of software can be catastrophic and too often we find business owners produce what we describe as ‘computerised shoebox’ records that cause frustration, waste time and create additional fees. This conflicts with our mission of helping you slash the time and cost associated with bookkeeping and GST compliance.

Here at Sheridans Accountants, we will be your accountants and business advisors. We do more than ‘keep the score’ for

our clients and when selecting the most appropriate accounting software for your business we

always recommend you match your business needs with your level of accounting skill. You’ll find we support a range of different

software programs but we do have a preference for cloud based solutions like Xero

because of their flexibility and the fact that you can access your financial data via the internet and invite your accountant or bookkeeper

to view your accounts at the same time. This means you can get bookkeeping support and valuable advice in real-time. You can also log-in

anytime, anywhere on your Mac, PC, tablet or smart phone to get a real-time view of your cash flow. Your data is automatically backed up and

users have access to the latest version of your financial data plus you never need to worry about installing software or program updates.

always recommend you match your business needs with your level of accounting skill. You’ll find we support a range of different

software programs but we do have a preference for cloud based solutions like Xero

because of their flexibility and the fact that you can access your financial data via the internet and invite your accountant or bookkeeper

to view your accounts at the same time. This means you can get bookkeeping support and valuable advice in real-time. You can also log-in

anytime, anywhere on your Mac, PC, tablet or smart phone to get a real-time view of your cash flow. Your data is automatically backed up and

users have access to the latest version of your financial data plus you never need to worry about installing software or program updates.

To build a house you also need the right tools. We have developed a number of tools including a start-up

expense checklist broken

down into various categories including:

-

tools and equipment

tools and equipment

- professional advice and software

- information technology costs – software and hardware

- marketing and signage

This checklist will help you identify all your potential establishment costs and these figures then feed through to our cash flow budget template and allow us to produce a projected profit and loss statement for your first year of trading. These reports can also tuck neatly into our business plan template that is designed to help you secure funding from external sources like a bank. Another useful tool is our business start-up checklist that walks you through key business registrations you might require, insurance options, legal issues, and domain name registrations for your website.

In summary, if you're contemplating starting a business you don't need to reinvent the wheel, as we have all the tools and resources to help

you get off to a flying start. In fact, that’s just the beginning because as accountants we can do some financial modelling, prepare

some ‘what if’ calculations and use industry benchmarks to compare the performance of your business against your competitors so

you understand what is working in the business and what areas need working on.

We will help you understand the four ways to grow a business plus identify the key

profit drivers in your business. We can walk you through a number of profit improvement strategies and even quantify the profit improvement

potential in your business. Our role is to make sure you know your numbers so you can set goals and see your improvements and success.

Our mission is to help you fast track your business success and we offer you a range of accounting, taxation, marketing and business

coaching services including:

We will help you understand the four ways to grow a business plus identify the key

profit drivers in your business. We can walk you through a number of profit improvement strategies and even quantify the profit improvement

potential in your business. Our role is to make sure you know your numbers so you can set goals and see your improvements and success.

Our mission is to help you fast track your business success and we offer you a range of accounting, taxation, marketing and business

coaching services including:

- Start-Up Business Advice for Psychologists

- Tools including the Start-Up Expense Checklist and Templates for a Business Plan, Cash Flow Budget

- Advice and Assistance with the Establishment of Your Business Structure - Company, Trust, Partnership

- Tax Registrations including ABN, TFN, GST, WorkCover South Australia etc.

- Preparation of Business Plans, Cash Flow Budgets and Profit Projections

- Accounting Software Selection and Training – Bookkeeping, Invoicing, & Payroll

- Preparation and Analysis of Financial Statements

- Preparation of Finance Applications - Loans to Buy a Business, Expand,

- Bookkeeping and Payroll Services - MYOB, Cashflow Manager, Xero, & Others

- Tax Planning Strategies

- Wealth Creation Strategies and Financial Planning Services including Transition to Retirement & SMSF's

- Industry Benchmarking and Management of Key Performance Indicators (KPI's)

- Advice & Assistance with Pricing your Services

- Business & Risk Insurances (Income Protection, Life Insurance etc.)

- Business Succession Planning

In summary, we are so much more than just tax accountants. We are business and profit builders who strive to deliver practical, cost effective advice that could give you a serious competitive edge in your industry and over the past two decades psychologists have become a niche within our firm.

Our knowledge of the psychology industry distinguishes us from other accounting firms. If you're a committed and ambitious business owner looking to accelerate your success we invite you to book a FREE, one hour introductory consultation to discuss your business needs. You can expect an hour of practical business, tax and financial advice that could have a profound effect on your future business profits. To book a time, contact us today and let's get to work on your business so it's more profitable and efficient.